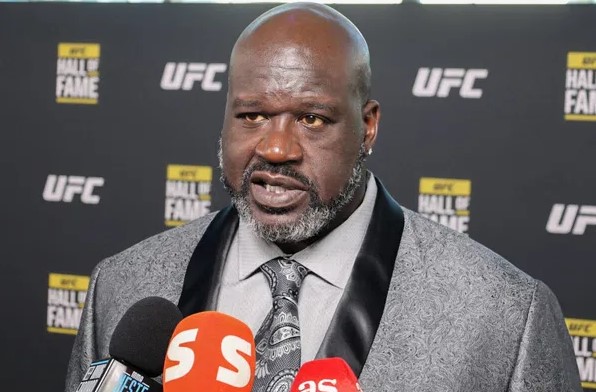

Shaquille O’Neal Falls Victim to Cryptocurrency Scam on Instagram After Losing $27M Asset

Basketball legend Shaquille O’Neal, who dominated the NBA courts for nearly two decades and built a massive fortune estimated at over $400 million, has become the latest high-profile victim of a sophisticated cryptocurrency scam that unfolded through Instagram’s messaging platform. The four-time NBA champion, known for his towering 7’1″ frame and equally impressive business acumen, reportedly lost approximately $27 million in digital assets after falling prey to what cybersecurity experts are calling one of the most elaborate crypto fraud schemes targeting celebrities in recent memory.

The scam began when O’Neal received what appeared to be a legitimate direct message on Instagram from an account impersonating a well-known cryptocurrency investment firm, complete with verified-looking badges and professional branding that mimicked authentic financial institutions. According to sources close to the investigation, the perpetrators had spent months crafting a convincing online presence, creating fake testimonials, doctored investment portfolios, and even fabricated news articles to establish credibility before targeting high-net-worth individuals like the former Lakers superstar.

The fraudulent scheme promised O’Neal exclusive access to a “celebrity-only” cryptocurrency investment opportunity that allegedly guaranteed returns of 300% within six months, leveraging his FOMO (fear of missing out) psychology that has driven many investors into risky financial decisions. The scammers presented themselves as representatives of a legitimate blockchain technology company, complete with professional documentation, fake regulatory approvals, and testimonials from other supposed celebrity investors who had purportedly made massive profits through their platform.

What makes this case particularly alarming is the sophisticated social engineering tactics employed by the criminals, who had apparently researched O’Neal’s investment history, business ventures, and personal interests to create a highly personalized and convincing pitch. The fraudsters knew about his previous successful investments in companies like Ring, Papa John’s, and various tech startups, using this knowledge to build trust and present their cryptocurrency scheme as a natural extension of his diversified investment portfolio.

The scam unfolded over several weeks, with the perpetrators gradually building O’Neal’s confidence through small initial transactions that appeared to generate profits, a classic technique known as “pig butchering” where victims are fattened up before the final devastating blow. These early “wins” were actually fabricated using sophisticated software that displayed fake trading results and inflated account balances, creating the illusion of legitimate investment gains that encouraged O’Neal to invest increasingly larger amounts.

The turning point came when the scammers convinced O’Neal to transfer $27 million worth of Bitcoin and Ethereum to what they claimed was a “secure smart contract” that would automatically execute high-frequency trading strategies on his behalf. Within hours of the transfer, the digital assets had been moved through multiple cryptocurrency wallets across different blockchain networks, making recovery virtually impossible through traditional legal channels.

Cybersecurity experts analyzing the case have identified several red flags that could have prevented this devastating loss, including the unsolicited nature of the initial contact, promises of guaranteed returns that far exceeded market norms, and pressure tactics that created artificial urgency. The Federal Bureau of Investigation has since launched a comprehensive investigation into the incident, working with international law enforcement agencies to track the stolen cryptocurrency and identify the perpetrators behind this elaborate scheme.

This incident serves as a stark reminder that even the most successful and presumably financially sophisticated individuals can fall victim to increasingly sophisticated cryptocurrency scams that exploit psychological vulnerabilities and leverage social media platforms to gain credibility. The case has prompted calls for stricter verification procedures on social media platforms, enhanced cryptocurrency exchange monitoring, and greater public education about the warning signs of digital asset fraud.

O’Neal’s representatives have issued a statement acknowledging the incident while emphasizing their commitment to working with law enforcement to prevent similar crimes from affecting other potential victims. The basketball legend’s experience highlights the urgent need for comprehensive regulatory frameworks that can keep pace with rapidly evolving cryptocurrency fraud schemes while protecting investors from increasingly sophisticated criminal enterprises operating in the digital asset space.